Discover the Savings!

$30 Million Reasons To Choose Rivermark

At Rivermark, "building financial empowerment together" is a mission we take seriously. We are always looking for ways to keep more of your hard-earned money in your pocket.

Over the past year, Rivermark members saved more than $30 million by simply having their accounts at their local credit union versus a national bank. The average member saved $390, while members with 5 services saved $1,021.*

On average, Rivermark members saved $390 each last year just by having their accounts with Rivermark versus a leading bank.* If your membership savings amount was more than that, congratulations! You’re likely making great use of your Rivermark membership. But would you like to be saving more? If you saved less than $390 you may not be taking full advantage of all that your membership can offer.

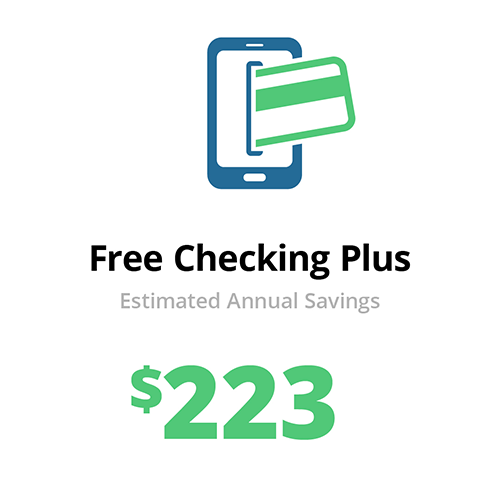

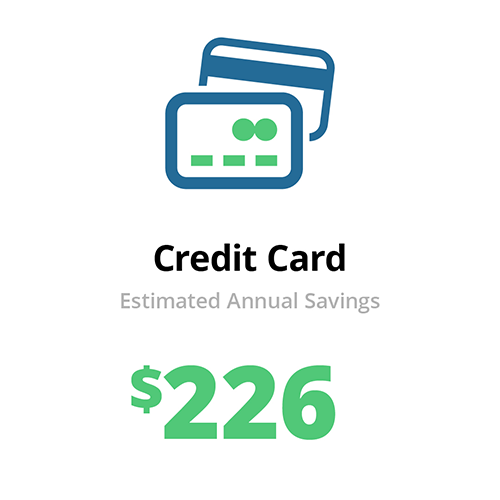

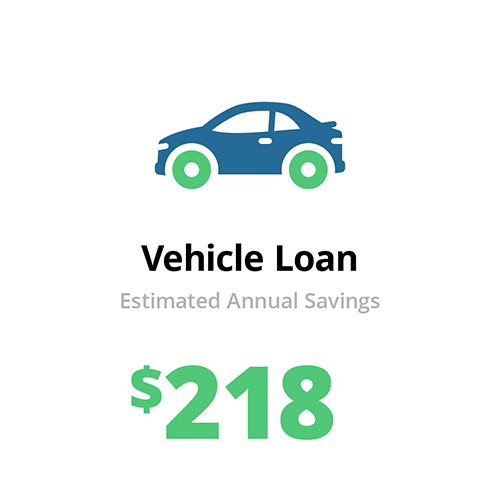

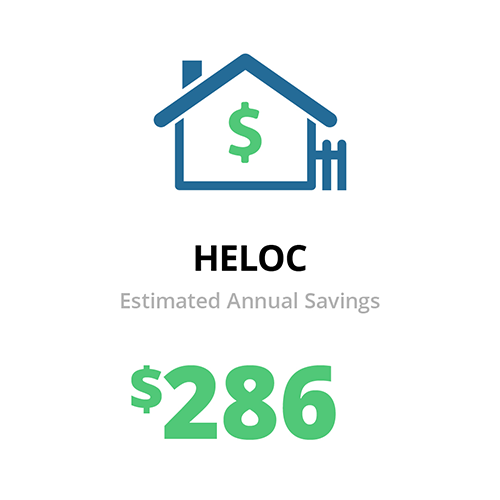

The More Products You Have, The More You Save

Our market research demonstrates that the easiest way to save more is to do more with us. We know that the deeper our financial relationship is with you, the more you save. Members with one Rivermark account saved an average of $43 annually, whereas members with six accounts saved an average of $1,217.*

Next Steps

Know that Rivermark is here to help you make the most of your money and resolve financial obstacles every step of the way. That's why we invite you to schedule a no-cost Financial Checkup at a branch or by phone.

Reviewing your finances with our highly trained team members can be informative, can reduce financial stress and could help save you money.

The Math

SUMMARY: Savings amounts are estimates and are for illustration purposes only. The estimates illustrate projected savings for an entire year, regardless of when an account was opened, and do NOT constitute a cash payout, dividend, or bonus.

CALCULATIONS: Financial institutions with comparable rate tiers and pricing structures were used to determine an average rate within each product type. Individual savings were then estimated by determining the difference between current Rivermark rates and the average rates, and then applying this differential to your Rivermark rates. In some rare cases, deposit and/or loan relationships were compared to the most similar product for which market rate information was available. Rates are subject to change at any time without notice. Business accounts were excluded from these calculations.

The savings amount for all loan relationships, including credit cards, was determined based on balances as of 2/28/22. If your balance is not carried over month to month, your savings amount would be less.

FEES: Fees were also taken into consideration when calculating the benefit associated with certain account relationships, using the average fees charged by competitors for that particular account, compared with the fees charged at Rivermark. We did not include penalty or “occasional” fees such as overdraft fees, stop payment fees, foreign item fees, etc. Rivermark has very few account maintenance fees, so your membership really helps you save big in the fee area.

DATA: The bank rate and fee information was obtained from Curinos (formerly Informa Research) on 2/10/22. Although the information provided by Curinos has been obtained from the financial institutions themselves, neither Rivermark nor Curinos can guarantee absolute accuracy as rates can change without notice.