Articles

Explore our library for financial tips, budgeting strategies, inspiring community stories, and more!

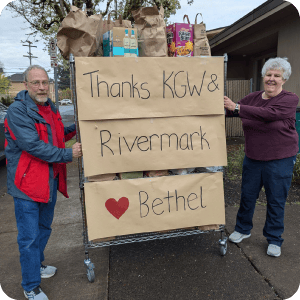

Rivermark Partners with KGW Local Lift

Rivermark is proud to partner with KGW as the sponsor of their new Local Lift segment. Together, we’ll spotlight the great work being done by nonprofit organizations in Oregon and SW Washington.

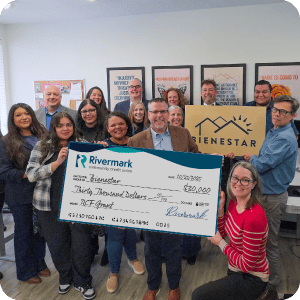

Rivermark Donates $30,000 to Bienestar

The Rivermark Community Fund has awarded its 2025 grant of $30,000 to Bienestar, the Hillsboro-based nonprofit providing safe, stable, and affordable housing for Latinx individuals, immigrants, and families in need across Washington County.

Fraud & Identity Theft: Protect Yourself

News of the latest TransUnion data breach is a great reminder to remain vigilant, protect your personal information, and reduce the risk of fraud or identity theft.

KGW Great Food Drive 2025

The 2025 KGW Great Food Drive has officially wrapped up, and we are proud to share the incredible impact made possible by the unwavering generosity of our community. In partnership with KGW, Toyota, Safeway, Pacific Office Automation, and many other dedicated supporters, Rivermark helped provide over 1.2 million meals...

Rivermark Donates $3 Million to Rebuilding Together

PORTLAND, OR – The Rivermark Community Fund has directed a grant of $3 million through the support of the Federal Home Loan Bank of Des Moines (FHLB) to Rebuilding Together, a non-profit organization that works to improve the lives of low-income homeowners in the community by providing free home repairs and...

7 Easy Steps to Build an Emergency Fund

Are you prepared for an emergency? If not, you need to start building an emergency fund today. This is money that you save specifically for emergencies. When something unexpected comes up and you need money fast, your emergency fund will be there to help you out. Follow these 7 simple steps and you will be on your way...

30 Day Financial Cleanse

Bad financial habits tend to creep up on us until they compound into big problems. It’s only when we can’t keep up on our debt payments or during an embarrassing situation, that we take notice and decide to do something about it. A financial cleanse is a great way to make lasting changes.