Leave High Interest Behind

Consolidate higher rate debt with a Rivermark Personal Loan. Rates as low as 9.45% APR for a limited time.

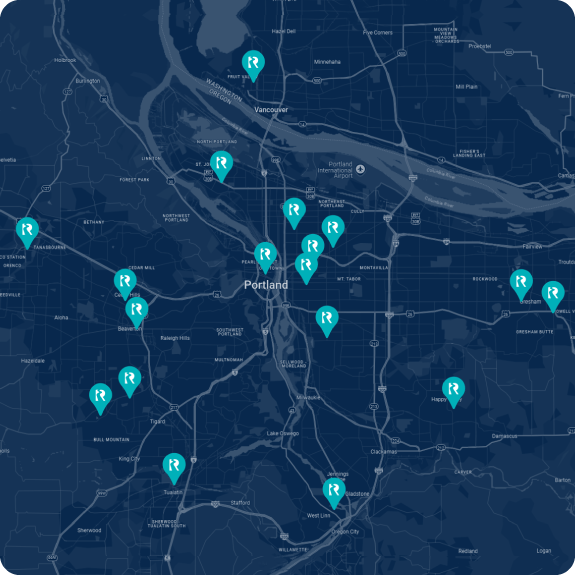

Top Rated Digital Banking

Bank anywhere, anytime, with our digital banking access and tools.

Let's Get Started

KGW Great Food Drive

2025 Rivermark Tax Information

Get ready for Tax Day with key dates for mailed and digital statements, mortgage 1098 details, and important guidance on accessing and organizing your year‑end tax documents.

Learn More

Government Shutdown Assistance

If you’ve suffered loss of wages due to the government shutdown, you may be eligible for our 0% Emergency Loan to assist those who need temporary financial relief.

Learn MoreToday's Rates

-

10 Month Loyalty CD

View All RatesAs high as 3.50% APY*

-

9 Month Promo CD

View All RatesAs high as 4.00% APY*

-

Rewards Checking

View All RatesAs high as 3.00% APY*

-

New Member Savings

View All RatesAs high as 3.00% APY*

-

Auto 2022 & Newer

View All RatesAs low as 5.99% APR**

-

Platinum Credit Card

View All RatesAs low as 8.90% APR**

-

HELOC

View All RatesAs low as 6.99% APR**

-

30 Year Fixed Mortgage

View All RatesAs low as 6.194% APR**

* APY = Annual Percentage Yield.

** APR = Annual Percentage Rate.

Quick Links

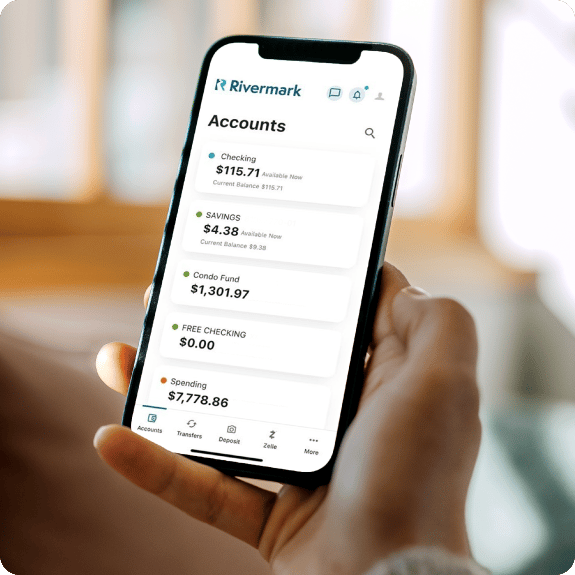

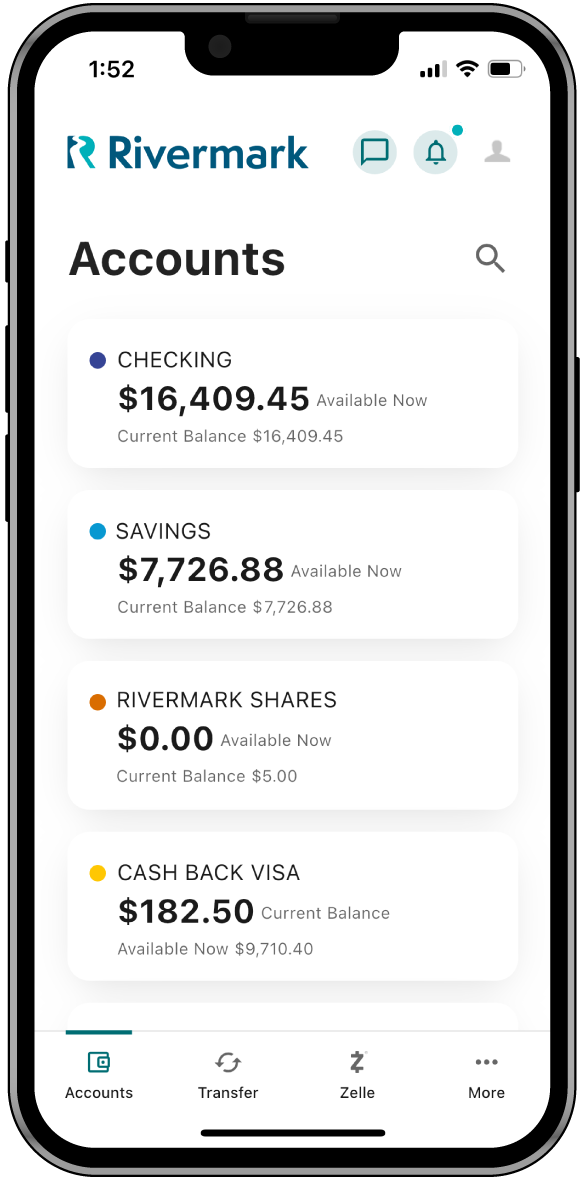

The Branch in Your Hand

Our cutting-edge mobile banking app puts you in control of your finances, wherever you go!

-

Manage Your Money

Check your balances, transfer funds, pay bills, deposit a check, access your statements, and more.

-

Check Your Rewards

Banking at Rivermark is rewarding! Track your monthly checking rewards status or redeem your credit card Cash Back within the app.

-

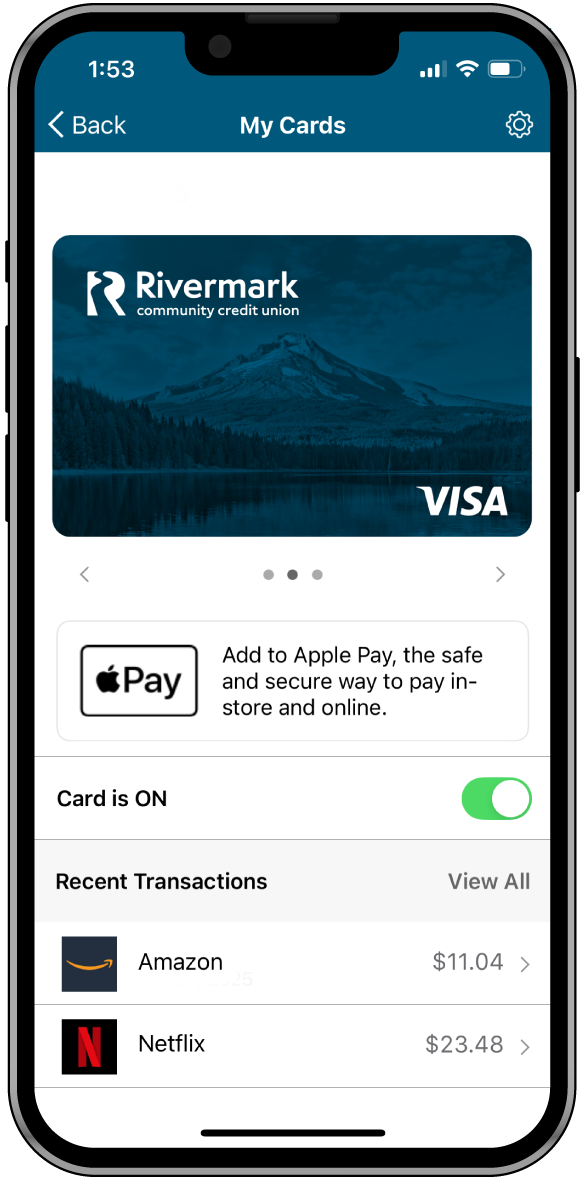

Card Controls

Instant card activations, card on/off, travel notifications, and robust fraud protections. Manage your debit and credit cards from one convenient place.

-

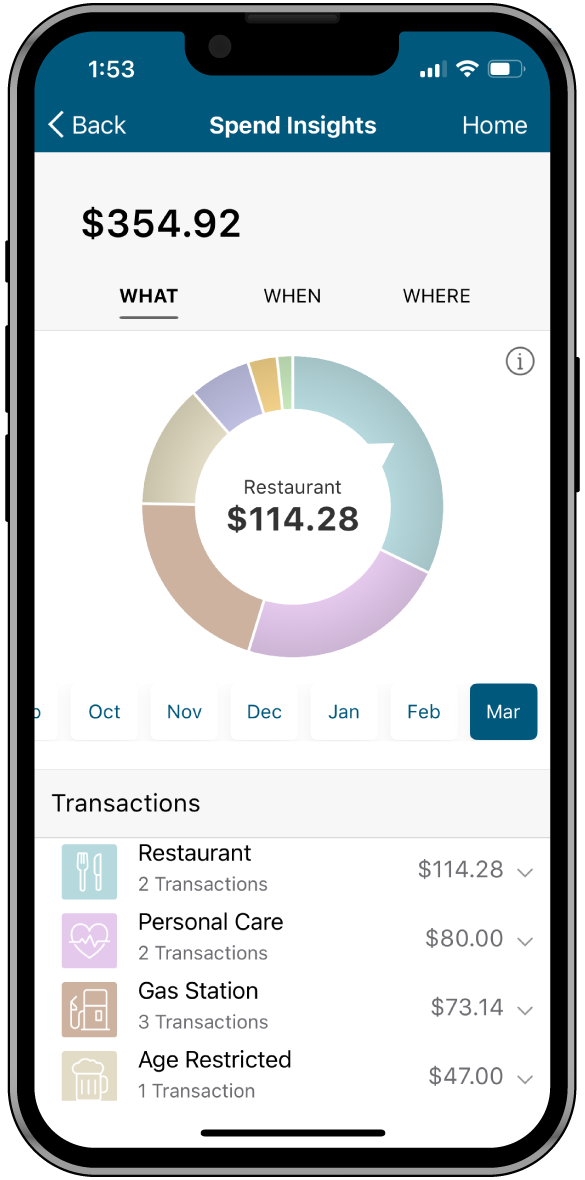

Spending Insights

Explore details about what, when, and where you're spending your money using your debit or credit card.

KGW Local Lift

Rivermark is proud to sponsor KGW’s Local Lift segment, highlighting nonprofits making a difference in our communities. Among them is Rebuilding Together PNW, which provides no-cost critical home repairs for low-income Portland homeowners, helping families stay safe and independent. Rivermark has supported their mission with grants totaling over $3 million, reflecting our commitment to community engagement and empowerment.

Latest From Our Blog

-

In The Community Rivermark News

In The Community Rivermark NewsCommunity Spotlight: Bradley Angle

Safety, Healing, Hope Rivermark is a proud community partner of the Portland nonprofit Bradley...Read More about Community Spotlight: Bradley Angle -

In The Community Rivermark News

In The Community Rivermark NewsRivermark Secures Affordable Housing Grant for Veterans

Rivermark recently secured the maximum $3 million grant from the Federal Home Loan Bank of Des...Read More about Rivermark Secures Affordable Housing Grant for Veterans -

In The Community Rivermark News

In The Community Rivermark NewsSpotlight on Rebuilding Together PNW

Rivermark and longtime media partner KGW are showcasing Rebuilding Together PNW as part of the KGW...Read More about Spotlight on Rebuilding Together PNW -

In The Community Rivermark News

In The Community Rivermark NewsRivermark Invests $150K With Sunshine Division

We’re proud to share that Rivermark is investing $150,000 over three years with our longtime...Read More about Rivermark Invests $150K With Sunshine Division

-

Security and Fraud Rivermark News

Security and Fraud Rivermark NewsFraud & Identity Theft: Protect Yourself

News of the latest TransUnion data breach is a great reminder to remain vigilant, protect your...Read More about Fraud & Identity Theft: Protect Yourself -

Security and Fraud

Security and Fraud10 Important Cyber Security Tips

More than half of the world's population could have had their private information leaked online!...Read More about 10 Important Cyber Security Tips -

Security and Fraud

Security and FraudHow to Avoid Spoofing Scams

Credit union members in the Northwest are falling victim to a new twist on classic telephone...Read More about How to Avoid Spoofing Scams -

Security and Fraud

Security and FraudAvoiding Senior Scams

If you have a senior you care for, we are starting a brand-new series just for you. We will...Read More about Avoiding Senior Scams

-

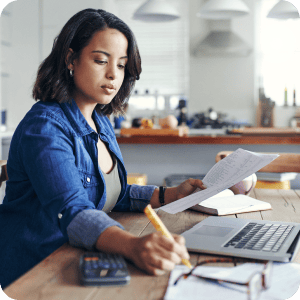

Savings Strategies

Savings Strategies7 Easy Steps to Build an Emergency Fund

Are you prepared for an emergency? If not, you need to start building an emergency fund today. This...Read More about 7 Easy Steps to Build an Emergency Fund -

Savings Strategies

Savings Strategies30 Day Financial Cleanse

Bad financial habits tend to creep up on us until they compound into big problems. It’s only...Read More about 30 Day Financial Cleanse -

Savings Strategies

Savings StrategiesStart a Budget

For a lot of folks, the first step to setting a budget is often the hardest, because you have to...Read More about Start a Budget -

Savings Strategies

Savings Strategies12 Day Financial Success Advent Calendar

Advent calendars are all about getting little prizes over the course of a few days or weeks with...Read More about 12 Day Financial Success Advent Calendar

-

Debt Management

Debt ManagementQuick Tips to Pay Down Debt

Getting rid of your consumer debt is an excellent way to increase your credit score, relieve...Read More about Quick Tips to Pay Down Debt -

Debt Management

Debt Management6 Good Uses for a Personal Loan

Even the most careful of investors and planners can sometimes get caught off guard by life....Read More about 6 Good Uses for a Personal Loan -

Debt Management

Debt Management8 Tips to Eliminate Debt Now

Debt is something many people deal with in their life. It can feel difficult to tackle, which is...Read More about 8 Tips to Eliminate Debt Now -

Debt Management

Debt ManagementPaying Down Credit Card Debt

There are many benefits to focusing on paying down debt. Paying off consumer debt protects your...Read More about Paying Down Credit Card Debt

-

In The Community Rivermark News

In The Community Rivermark NewsCommunity Spotlight: Bradley Angle

Safety, Healing, Hope Rivermark is a proud community partner of the Portland nonprofit Bradley...Read More about Community Spotlight: Bradley Angle -

In The Community Rivermark News

In The Community Rivermark NewsRivermark Secures Affordable Housing Grant for Veterans

Rivermark recently secured the maximum $3 million grant from the Federal Home Loan Bank of Des...Read More about Rivermark Secures Affordable Housing Grant for Veterans -

In The Community Rivermark News

In The Community Rivermark NewsSpotlight on Rebuilding Together PNW

Rivermark and longtime media partner KGW are showcasing Rebuilding Together PNW as part of the KGW...Read More about Spotlight on Rebuilding Together PNW -

In The Community Rivermark News

In The Community Rivermark NewsRivermark Invests $150K With Sunshine Division

We’re proud to share that Rivermark is investing $150,000 over three years with our longtime...Read More about Rivermark Invests $150K With Sunshine Division