Articles

Explore our library for financial tips, budgeting strategies, inspiring community stories, and more!

How to Avoid Outliving Your Money

If you are like most American workers, you will likely be responsible for saving most of the money you will need for retirement. That's because many companies have replaced defined-benefit (or pension) plans with defined-contribution (or 401k) plans. Furthermore, Social Security will only cover a fraction of the...

Will Getting Married Change My Tax Situation

Are you planning to get married or are getting married soon? If so, congratulations! As you and your significant other plan for the big day and your life together, there is a lot to take into consideration. And as fun as planning your wedding may be, don’t forget about your taxes as well – just because you have...

Avoiding Senior Scams

If you have a senior you care for, we are starting a brand-new series just for you. We will provide essential information and resources for seniors in your life. Many times, financial and other issues faced by seniors can go overlooked or unnoticed. We'll share tips to help you identify potential problems. Scammers...

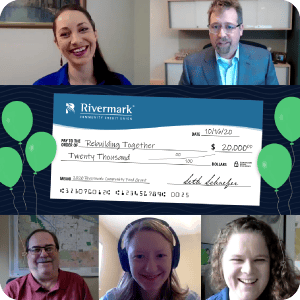

Rivermark Awards $20,000 to Rebuilding Together

As a mission-driven not-for-profit organization, Rivermark continues to focus its community giving on organizations and programs that support housing insecurity, food insecurity, and children’s health and welfare.

What You Should Know if You're Close To Retirement

The closer you get to retirement, the more excited you may be—and more worried. If you are 18 to 24 months away from retirement, this article is for you. You may still be wondering if you have enough saved, or if you can (or should) plan on finding a supplemental income. How will an uncertain economy affect your...

Maintaining Your Home After Purchase

Owning your own home can be an excellent investment. It can also be financially draining if you aren’t regularly maintaining your home. Regular maintenance can take time, planning, and money, but it can help you to save on unexpected repair costs and keep the value of your home up. Below, we share some of our tips...

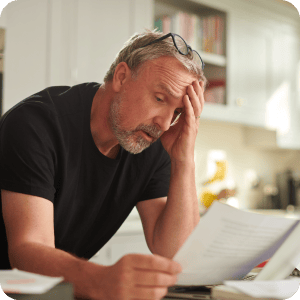

Coping with Financial Stress

There are plenty of good reasons to worry about money. We've all sat up at night, looking over bills or calculating expenses in our heads, wondering how to handle the present and plan for the future. Many Americans say that financial stress is a problem in their lives. Unfortunately, this worry can get out of...

Lowering Your Household Food Costs

These days, most households are looking for ways to cut down on grocery and dining costs. In this article, we take a look at practical ways your family can cut down on food costs, whether you cook at home or tend to order/eat out.