NCUA Share Insurance Overview

At Rivermark, we know that your money is important to you. Rest assured that there is no safer place for your money than a federally insured credit union. All of our members’ deposits are federally insured by the National Credit Union Share Insurance Fund (NCUSIF), a division of the National Credit Union Administration (NCUA), which is the federal regulator for credit unions.

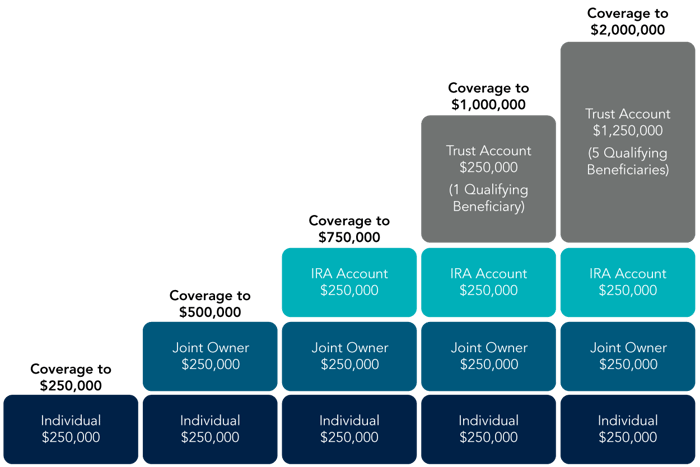

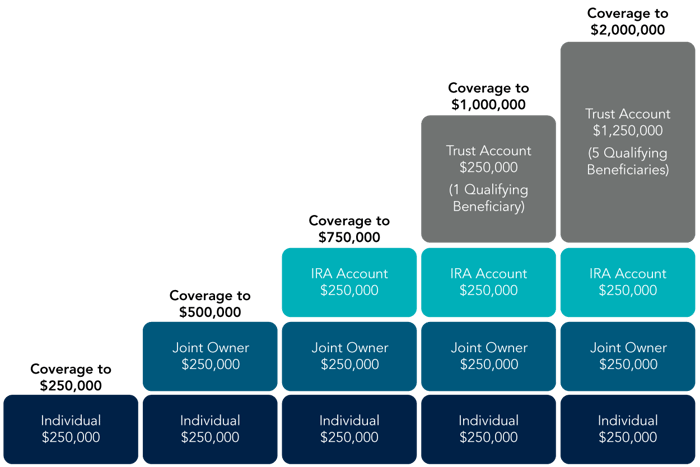

- The balances in your individual savings, certificate and checking accounts are insured up to $250,000

- Joint ownership can expand the overall insurance coverage. The combined balances in joint accounts are insured separately from individual accounts for up to $250,000 per name on the account. The most federal insurance coverage any member can have as a result of joint ownership is $250,000. (Example: If joint accounts total $500,000 and there are two owners on the account(s), each owner is insured for $250,000.)

- The funds in your IRA are insured up to $250,000.

- Trust Accounts, including Payable on Death Beneficiary accounts, have different rules that may provide additional coverage. Each Trust relationship must be evaluated individually to determine the appropriate eligible insurance coverage.

The graph below outlines how you can maximize your share insurance at a credit union.